A series from Fin365 documenting our use of Microsoft’s Copilot technologies in our own business. Post #9: Microsoft Copilot Studio

“What you have learned is that the capacity of the plant is equal to the capacity of its bottlenecks.”

– Eliyahu M. Goldratt (The Goal)

Curious about why we would compare a financial planning business to a manufacturing plant?

Download our free white paper:

‘Maximising (Profit) Flow

in a Financial Planning Practice.’

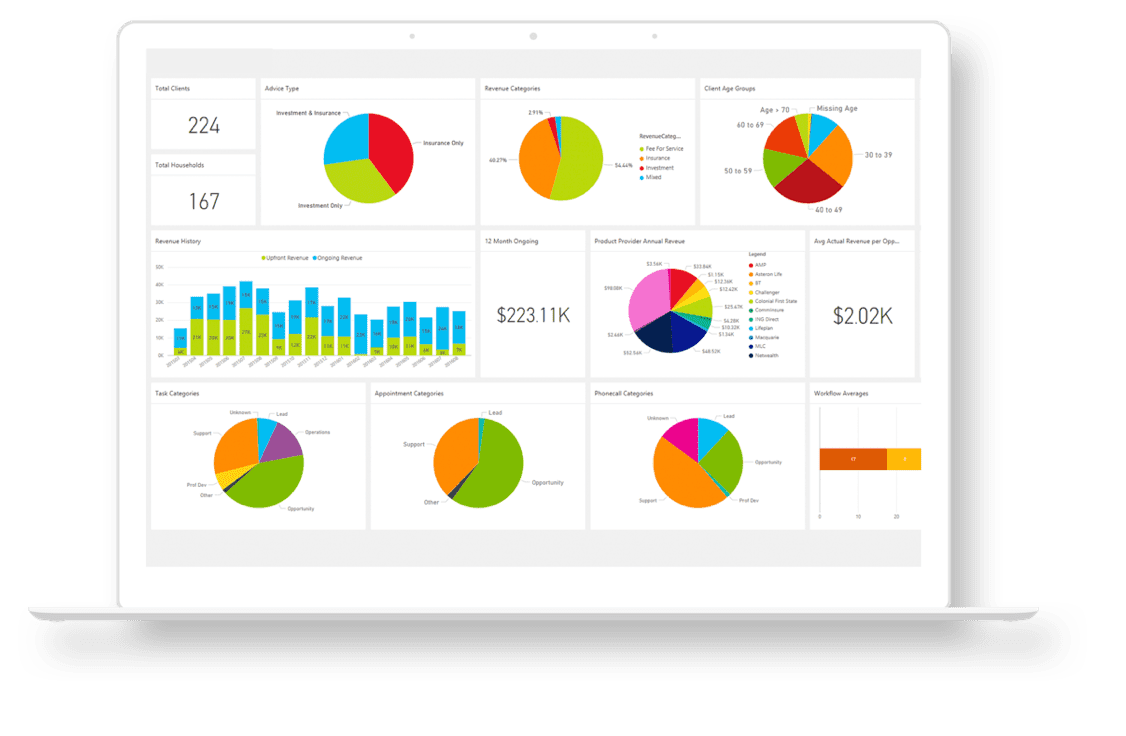

Enhance Business Performance

Increase Your Profit

Fin365 has been designed to improve the profitability of your business by:

> Improving your efficiency

> Intelligently tracking business revenue

> Reducing software costs

Enhance Team Performance

Fin365 shows team members how their efforts relate to overall business performance, helping everyone operate more effectively.

> Intelligent activity management

> Integrated project management

> Referral partner specific reporting

Improve Customer Satisfaction

Fin365 includes innovative tools, which encourage your clients to stay committed to the journey, by delivering some instant benefits, including:

> Interactive Client Web Portal

> Customisable Client Reports

> Automated Communications

Reduce Business Risk

Fin365 includes a range of quality control features that help minimise the risk as efficiently as possible.

> Monitor Compliance Requirements

> Track Communications History

> Enforce Business Policies

News

Keep up to date with Fin365 and industry news.

Technology Test Drive – Github Copilot

A series from Fin365 documenting our use of Microsoft’s Copilot technologies in our own business. Post #8: Github Copilot